If you caught our blog last week on Primark asking customers not to buy its products online, you might have been surprised to read that many enterprise brands are selling on Amazon directly.

The eCommerce landscape has changed significantly since the early days of Amazon being a book store, eBay being an auction site and Etsy only selling handmade items. Today, Amazon not only sells nearly everything from A to Z, but its sellers now range from the tiny lifestyle seller to the big enterprise brands.

But why would an enterprise brand want to sell via an online marketplace aimed at SMBs?

Why enterprise brands are selling on Amazon

Amazon is a huge selling tool – perhaps the biggest one out there. It surpasses Google for shopper inspiration, attracts on average 3,718 new sellers each day and will be accepting Christmas orders right up to (and including) Christmas eve.

But, while all of this is hugely attractive to even the biggest and most established of brands, the main goal of selling via Amazon isn’t profits – it’s third-party sellers.

Consumers expect Amazon to sell everything because, by and large, they do. So when a notable brand isn’t on Amazon, third-party sellers will step into the gap by supplying that product indirectly.

This is common practice for many brands and happens regularly on the high street. However, the ease of selling online has led to a surge of third-party sellers, which has become difficult for brands to monitor and control, causing several problems. These problems include:

Brand control

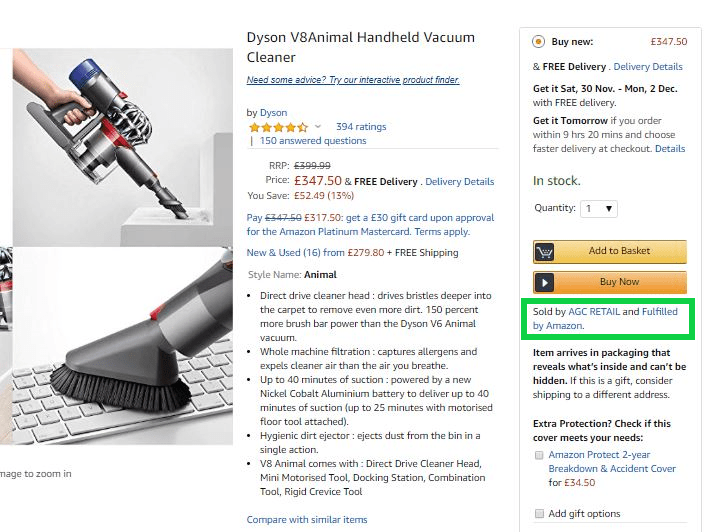

Enterprise brands have invested significant time, money and resources into building and sustaining their brand. Everything from storytelling and images to the customer experience and packaging used is controlled to align with a USP.

This control is lost as soon as products are sold via a third-party seller. While you would hope they use the USP to further sales, capacity and money can lead to corner-cutting and, ultimately, brand damage.

Price control

Enterprise brands have also created a unique price point for their products and a surrounding strategy. For example, high-end brands build a reputation around quality and innovation. While low-end brands build a reputation around value and affordability.

If a third-party seller sets their prices any differently, it diminishes this reputation. As you’ve already seen, Primark doesn’t want third-party sellers selling its products at a higher cost on Amazon because this ruins their USP of being an affordable brand.

Relationship control

Finally, when a third-party takes on the customer relationship, the brand loses control over how that relationship is handled, the data produced and any future relationship.

Of course, enterprise brands can employ large teams to manage these third-party relationships but instead, many are investing this money into selling direct-to-consumer online.

Who is selling via Amazon?

Selling D2C, especially via Amazon, is notably taking off in the States. Brands such as Apple, Calvin Klein and Black+Decker (to name a few) are using the online marketplace to reach customers directly and control their brand, pricing and data.

At Expandly, we’re seeing a surge in both British and American brands wanting to exploit the eCommerce landscape and begin multi-channel selling themselves online. And, online shoppers are also very interested in buying directly from brands. More than half of shoppers prefer doing so, and 40% expect 40% of their purchases to be directly from brands within the next five years.

Of course, as you’ll have noticed from our blog on Primark, not everyone wants to join the party. Whether these brands will go the same way as names such as Toys R Us, Mothercare, Bon Marche and Karen Millen, we’ll just have to wait and see.

If you’d like to know more about direct-to-consumer commerce and how you can integrate Amazon with your existing retail systems, get in touch with our enterprise team today at [email protected]